We’re excited to feature the SimCorp team on the Semantic Kernel blog today. The SimCorp team will discuss their AI journey and how they’ve integrated Semantic Kernel to build out their AI solutions. Let’s dive into the details from the SimCorp team!

SimCorp Background:

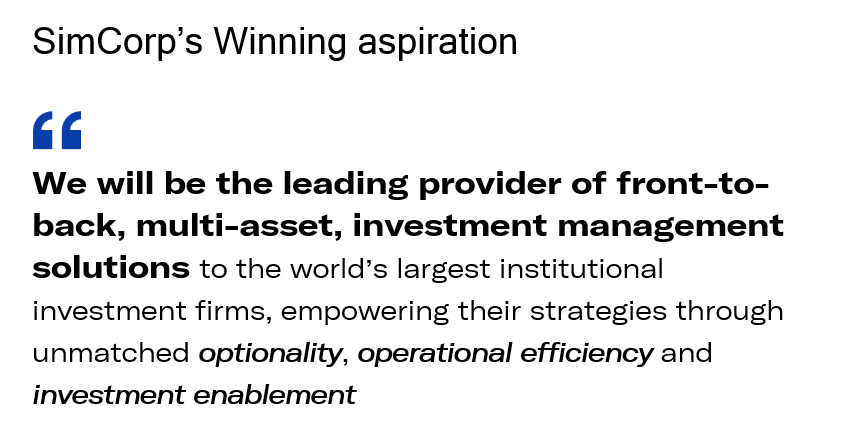

SimCorp was founded in 1971 and has continuously innovated to create an industry-leading integrated investment management platform that’s built to turn avalanches of information into insights that lead to the decisions that put our clients ahead of the competition. SimCorp’s efficient, flexible front-to-back-offering, provides clients with SaaS (Software as a Service) platform or on-premise solutions.

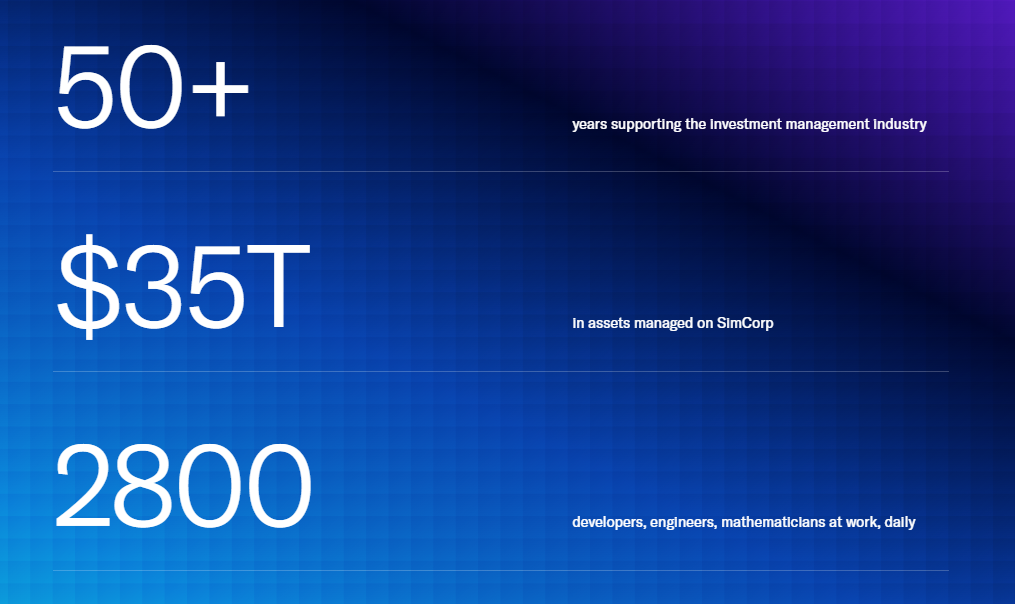

Some details about SimCorp since their founding:

SimCorp’s Key Objective:

SimCorp’s AI Strategy and Semantic Kernel Integration

SimCorp’s AI Platform: SimCorp is using Azure Machine Learning by Microsoft as their main AI platform. Currently, SimCorp supports all AI models on the Azure platform.

SimCorp’s Partnership with Microsoft Semantic Kernel: SimCorp is using Semantic Kernel to implement its vision due to its ease of use to integrate in their solutions. SimCorp is actively working with Microsoft on SimCorp’s AI roadmap.

The below interview details the value Semantic Kernel has provided SimCorp and its ease of use.

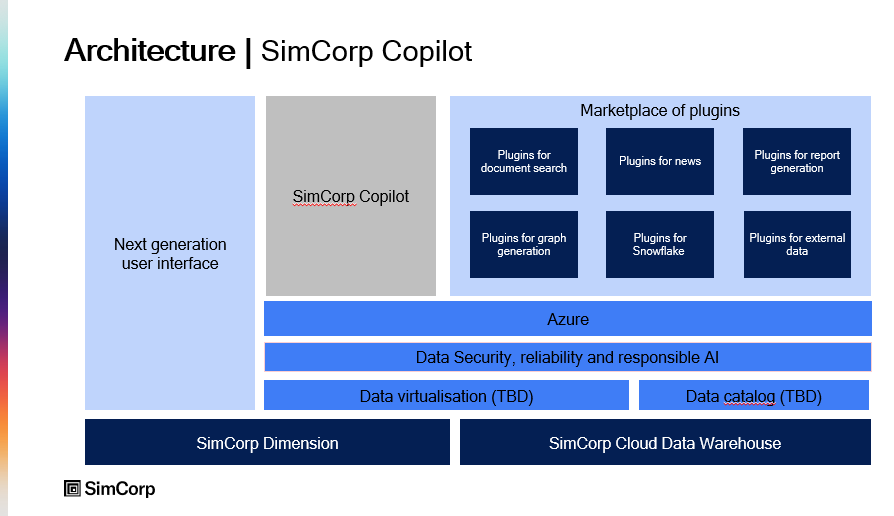

SimCorp Copilot:

One of the key things SimCorp is using Semantic Kernel for is their AI solution called SimCorp Copilot. SimCorp Copilot has more capabilities than a chatbot and is able to understand the context it’s in and then helps you do your job. Ideally the goal is SimCorp Copilot will know what you are trying to do and be able to pull in relevant data, while keeping data security, reliability and responsible AI top of mind. Below you can see details into the architecture of the solution and learn more in a brief video from SimCorp.

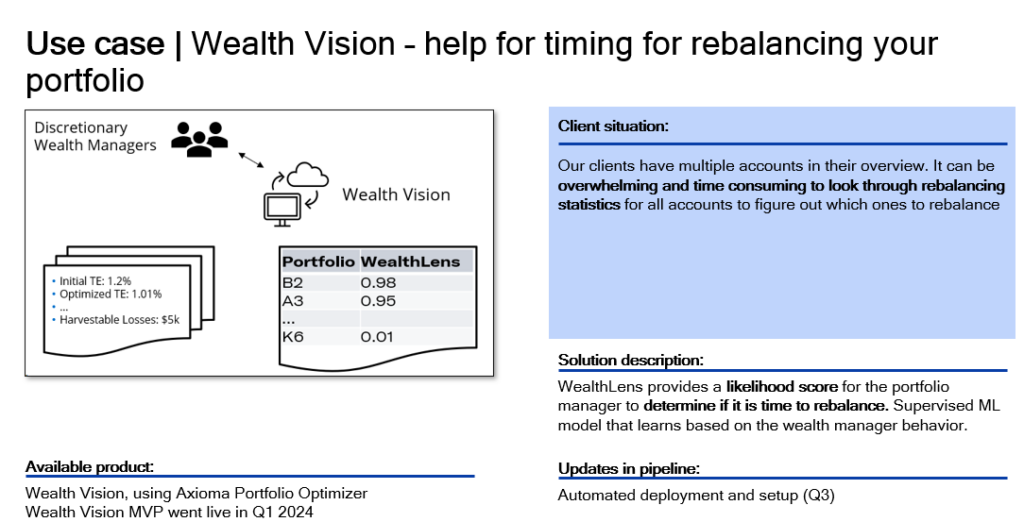

SimCorp’s Wealth Vision AI Solution:

SimCorp has developed a solution called Wealth Vision where you, as a portfolio manager, are provided with a list of portfolios to rebalance. The solution provides the individual with a tool called Wealth Lens which gives a score between 0.00 and 1.00 for each portfolio. A portfolio with a value of 1.00 is a prime candidate to be rebalanced, while a portfolio with a score of 0.00 does not need rebalancing.

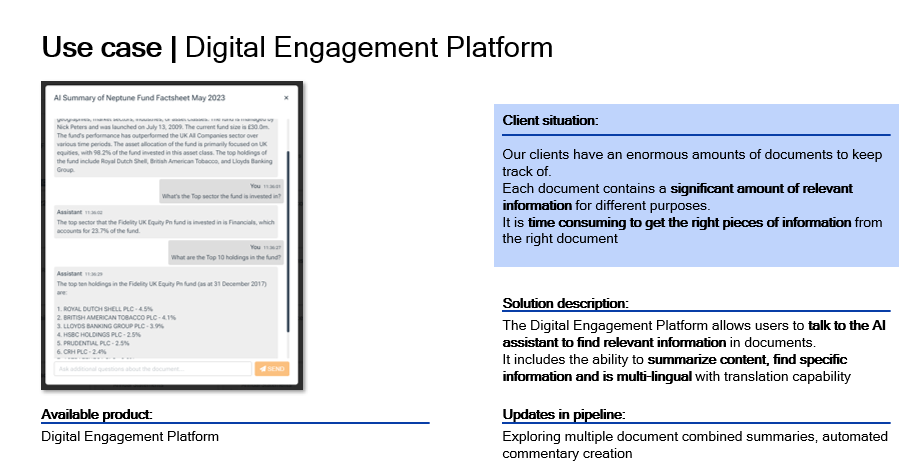

Demo | Digital Engagement Platform

The demo below showcases SimCorp’s digital engagement platform which provides an individual with information requested through retrieval augmented generation (RAG) by scanning documents.

Conclusion:

From the Semantic Kernel team, we want to thank the entire SimCorp team for their time. We’re always interested in hearing from you. If you have feedback, questions or want to discuss further, feel free to reach out to us and the community on the Semantic Kernel GitHub Discussion Channel! We would also love your support, if you’ve enjoyed using Semantic Kernel, give us a star on GitHub.

Thanks again to the SimCorp team for their amazing work and partnership!

0 comments